|

In business, as in life, the task of exerting control is commonly perceived as being one of exercising limits; of saying 'no' and imposing constraints. Such perceptions are well-founded. Check these verb usages of 'control', lifted straight from the dictionary:

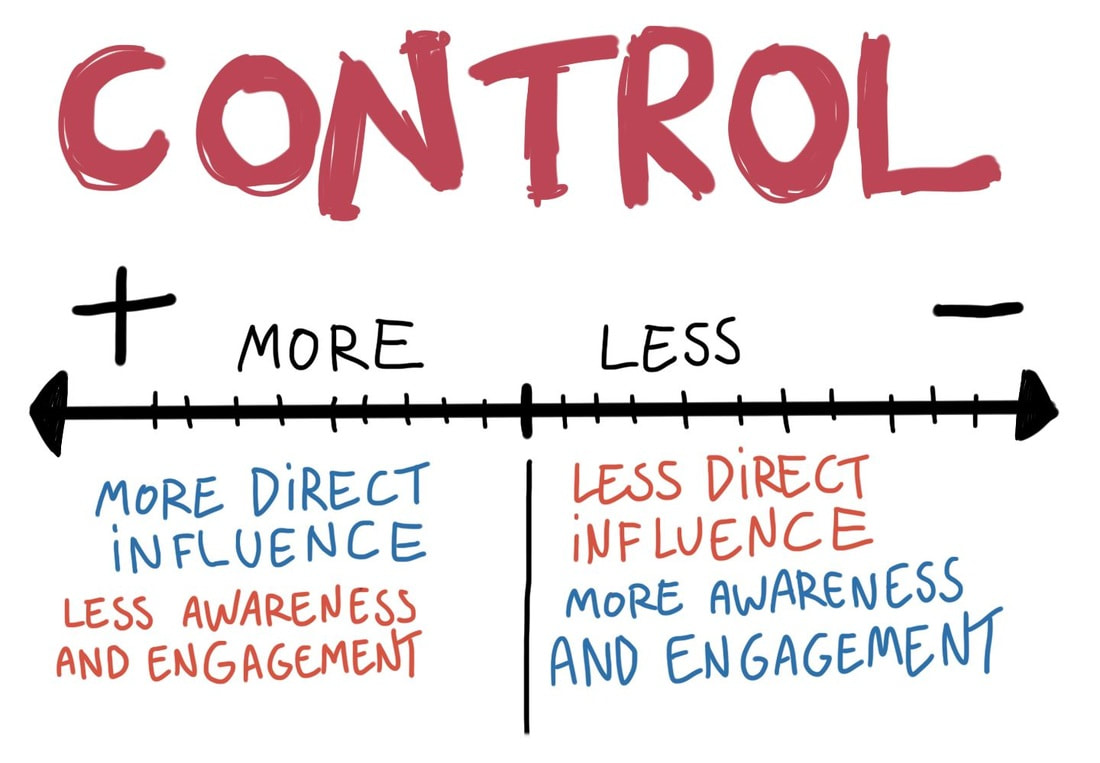

If you have spent much time in boardrooms, you'll know that director behaviour tends to be consistent with these definitions, more so if the chief executive is ambitious or entrepreneurially-minded (the two attributes are not necessarily the same). When asked, board justification for exercising caution is straightforward: to keep the chief executive honest and to keep things 'on track'. Such an understanding—holding management to account—seems admirable. Monitoring and supervising management is one key task (of four) of corporate governance after all. But does a strong hand actually lead to better outcomes? More pointedly, how might the exercise of restraint and limits advance the purposes of the company (noting the board is responsible for ensuring performance goals are achieved)? Such conduct is analogous to applying the brake when the intention is to drive on. A growing body of academic and empirical evidence suggests that a strong hand, like increased compliance, may actually counter-productive. Rather than persist with what is demonstrably a problematic approach, it might be more fruitful for boards to consider another perspective. What if control is re-conceived in positive terms (namely, constructive control), whereby the board's mindset is to provide guidance (think: shepherd or coach) by ensuring the safety of the company and steering management to stay focused on agreed purpose and strategy? Might this deliver a better outcome? Emerging research (here, but contact me to learn more) suggests the answer is 'yes'. Strongly-engaged and strategically competent boards that display high levels of situational awareness as they debate issues from multiple perspectives and make informed decisions in the context of the long-term purpose of the company can make a difference. Constructive control is one of five important behavioural characteristics of effective boards identified in this research.

0 Comments

Research is a funny thing. On one hand, experience can be greatly helpful: knowing what one is looking for or expecting to see is a boon. On the other, experience can be a hinderance: knowledge often resulting in bias and preconception, and the very real possibility of missing vital clues. This is one of the great dilemmas for board and governance research. Some forty years have now passed since researchers started investigating boards in earnest. That an answer to the question of the role of the board and how they influence firm performance (i.e., what corporate governance is and how it is practiced) remains elusive is an indictment on the research community. Directors and boards need clear and well-founded guidance so they can become effective in role. Medical research is conducted by medics; cultural research is conducted by anthropologists; and, engineering research is conducted by engineers, so why is board research typically conducted by academics with little if any business experience? How might a researcher who has never been inside a boardroom hope to recognise the normative practices of board meetings? Or that a subtle interaction between two directors might actually be material to a pending decision? That most board and governance researchers have never been in a boardroom or served as a director is alarming. Yes, gaining access to observe boards directly is difficult to achieve. But to restrict board and governance research to counting isolated attributes of boards from outside the boardroom is folly. To be useful, recommendations need to account for the socially-dynamic nature of boards and the behaviours of directors (both of which can only be reliably discerned through direct observation). If the question of explaining how boards influence firm performance is to be answered, three things are needed:

After a longish hiatus—nearly four months—Musings is back. Thank you to regular readers and supporters who have asked about the radio silence. The explanation is straightforward: a busy period of speaking and advisory engagements, research and board work left precious little time to ponder. But that is history now. My intention is to pick up where I left off in early August, by posting on topical matters and emerging trends; challenging orthodoxy and, importantly, exploring how boards might become more effective in their pursuit of high firm performance and sustainable wealth creation. Thank you for your interest in Musings. Your feedback and commentary is appreciated.

|

SearchMusingsThoughts on corporate governance, strategy and boardcraft; our place in the world; and other topics that catch my attention. Categories

All

Archives

May 2024

|

|

Dr. Peter Crow, CMInstD

|

© Copyright 2001-2024 | Terms of use & privacy

|