|

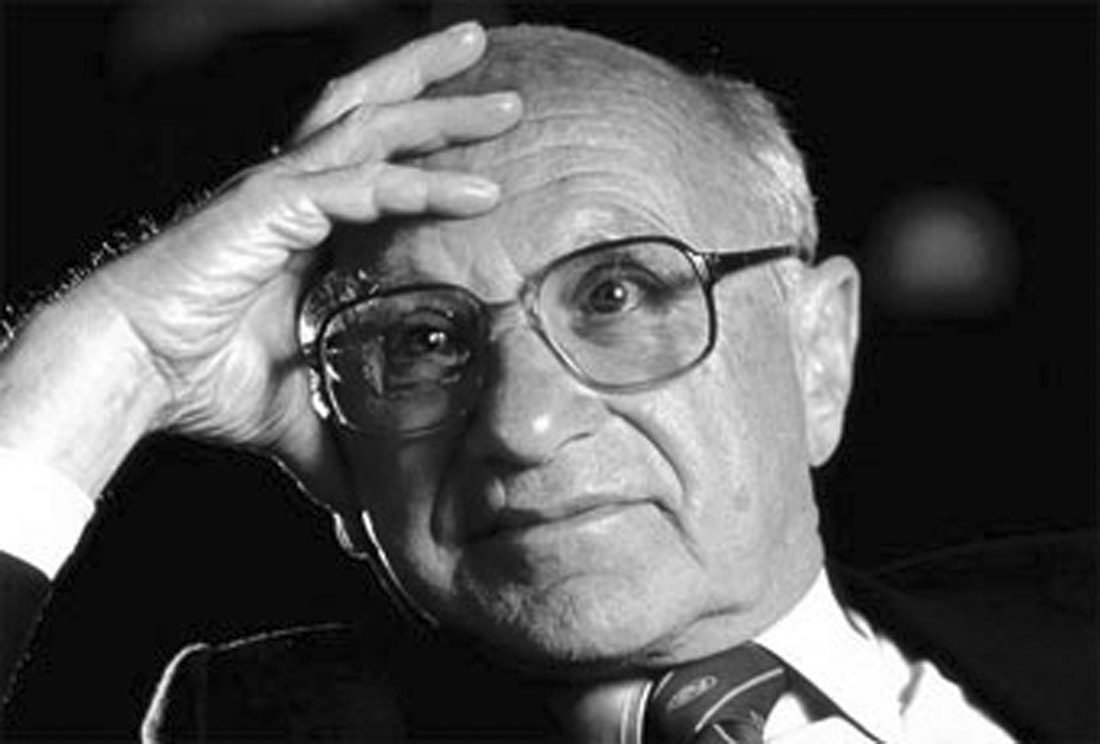

In September 1970, The New York Times Magazine published an article that subsequently became a catalyst, a touchpaper even, for a step change in the understanding of the purpose of business and, as a consequence, the priorities of managers and boards of directors. Milton Friedman, an economist and Nobel laureate, argued that the doctrine of 'shareholder primacy' should prevail over that of 'social responsibility'. The article garnered much attention (becoming seminal along the way) especially amongst those shareholders, directors and managers for whom the maximisation of profit was of primary (read: exclusive), interest. The statement most commonly used to justify the profit maximisation doctrine is right at the end of the article: "There is one and only one social responsibility of business—to use its resources and engage in activities designed to increase profits" Superficially, this statement is pretty clear: the purpose of business is profit and nothing else matters. But this statement is incomplete, a portion of a longer sentence. To stop reading at 'increase profits' is to read Friedman out of context. The complete sentence is as follows: "There is one and only one social responsibility of business—to use its resources and engage in activities designed to increase profits so long as it stays within the rules of the game, which is to say, engages in free and open competition without deception or fraud." Friedman was clear. He argued that the maximisation of profit is an important priority of companies, and he argued that this is not, and cannot be, an unbounded endeavour—much less an exclusive one. The proviso followed without as much as a comma—the pursuit of profit needs to occur within the context of prevailing law and regulation (rules of the game), competition and fair play. That Friedman's guidance was so clear begs a rather awkward question: Why has it been misinterpreted by so many shareholders and boards?

2 Comments

Henry D. Wolfe

8/9/2017 07:54:07

Peter:

Reply

Peter Crow

8/9/2017 13:39:20

Hi Henry. Thanks for your question. Many boards have focused on the first part of Friedman's comment—shareholders too—seemingly to the exclusion or without consideration of the second. Wells Fargo, VW, FIFA, BHS, Sports Direct, HSBC and Wynyard Group are recent examples. Whether they did so knowingly or not, all of these companies played outside the rules (profit at any cost).

Reply

Leave a Reply. |

SearchMusingsThoughts on corporate governance, strategy and boardcraft; our place in the world; and other topics that catch my attention. Categories

All

Archives

May 2024

|

|

Dr. Peter Crow, CMInstD

|

© Copyright 2001-2024 | Terms of use & privacy

|